how to lower property taxes in nj

Filing the appeal. Give power back to the people of New Jersey.

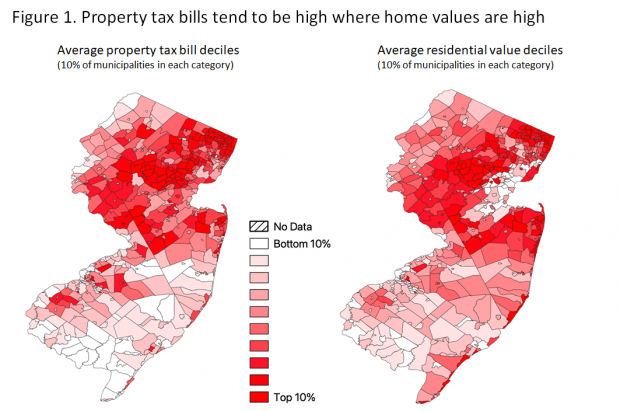

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

You must be age 65 or older or disabled with a Physicians Certificate or Social Security document as of December 31 of the pretax year.

. The state of New Jersey offers reduced property taxes if certain requirements are metIn the following section you will find a detailed overview of the New Jerseys various programsCredit or rebate to pay for a homesteadAlmost all New Jersey homeowners who paid their property taxes last year receive a rebate or credit towards their 2018 taxes. To qualify for property tax relief in NJ You need to be 65 or older or blind or disabled earning below 150000. 250 Property Tax Deduction for Senior Citizens and Disabled Persons.

On the towns website we quickly found the link to enter an online appeal with the countys board of taxation. Expenses incurred by tenants are deducted from taxes paid during the year of 18 rent. Click on your county.

Your local tax collectors office sends you your property tax bill which is based on this assessment. Ad Find New Jersey Property Tax Relief on sale now. Here are the programs that can help you lower property taxes in NJ.

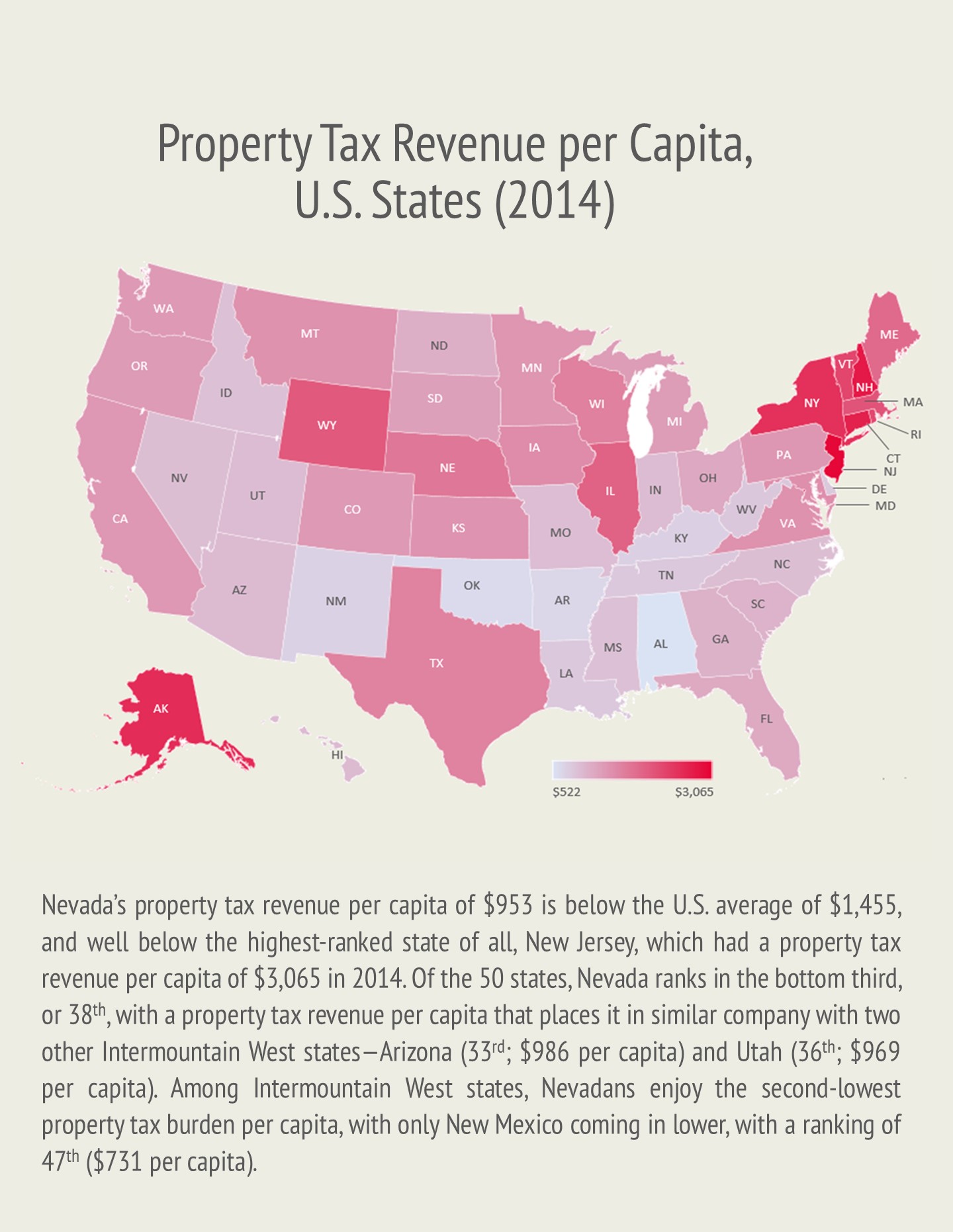

Be a legal resident of New Jersey for at least one year prior to October 1. Making Charitable Donations 3. Currently NJ has the highest property taxes in the States.

100 disabled veteran property tax exemption. Own and occupy your home as of October 1 of the pretax year. Moreover our fellow state an non-state workers that resides in our neighboring states like PA an work in NJ are spending their income in the state they reside.

If these three ratios are not between 0 and 1 then divide them by 100. NJs veteran property tax deduction is one way you can lower property taxesVeteran properties are exempt from federal property taxesMake sure you are a homeownerBe a legal resident of New Jersey for lifeExperience military service in the USHonorable discharge from the armed forces. New Jersey voters tried unsuccessfully in 1981 in 1983 and again in 1986 to.

Find the three tax ratios for your city. Leave the Money to Your Spouse 2. 100 Disabled Veteran Property Tax Exemption.

For example if your tax ratios are 2486 2925 and 3364 then divide them by 100 to get 2486 2925 and 3364. Call the Senior Freeze Information Line at 1-800-882-6597 for more information. Our Tax Pros Can Work With The IRS So You Dont Have To From Start To Solution.

Rasmussen said the average New Jersey renter who pays 1500 per month 18000 annually in rent would be able to deduct 2100 more than they would under current law. These programs are managed by your local municipality. New Jersey offers several property tax deductions exemptions and abatements.

Your tax bill might be lower or higher depending upon how much you paid for property taxes. Eligibility Requirements and Income Guidelines. 250 veteran property tax deduction.

New Jersey offers different tax relief programs not only typical exemptions but also deductions of 250 and deferments or postponements of tax payments. Ad If You Have IRS Issues No Matter How Big Embarrassing Or Scary Our Tax Pros Can Help. To qualify you must.

It allowed us to create a login and enter the evidence including. The deduction for Tax Years 2017 and earlier was 10000. 250 Veteran Property Tax Deduction.

Those below age 65 without a visual impairment or a disability are protected by 75000. Here are five interventions to cut spending and reduce property taxes. I definitely agree that there is an influx of families an retirees relocating out of state due to the high property taxes.

The deductible would increase from about 3240 to 5400 for the average. Remove Life Insurance Proceeds From Your Estate 6. Average Property Tax Rate.

Ad Local Tax Planning Experts. Woodbine Cape May County. In order to come up with your tax bill your tax office multiplies the tax rate by.

How to Reduce Your Estate Taxes Ways to Minimize Estate Taxes 1. Active military service property tax. Go to the New Jersey Division of Taxation website through the link in the References section.

Create an Estate Plan 5. Tax Debt Relief - What Are Your Options - Payment Plans and How Do They Work. The measure would change the deduction for rent payments considered as property taxes from 18 to 30.

We present you with a list of the towns with the lowest property tax rate in New Jersey belowcheck it out. Tax deductions exemption and deferment programs include. If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception.

100s of Top Rated Local Professionals Waiting to Help You Today. Give Your Money Away During Life 4. Find Out How To Reduce Your Tax Liability.

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Property Tax How To Calculate Local Considerations

Why Are My Property Taxes Higher Than My Neighbor S Credit Com

Property Taxes By State Embrace Higher Property Taxes

Pin On Real Estate Investing Tips

Florida Property Tax H R Block

Things That Make Your Property Taxes Go Up

Property Taxes Property Tax Analysis Tax Foundation

Cypress Texas Property Taxes What You Need To Know

Property Taxes In Nevada Guinn Center For Policy Priorities

Pin On Nutley Nj Real Estate Nutley Homes For Sale Www Homesinnutleynj Com

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Property Tax Comparison By State For Cross State Businesses

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)